Third Party Boat Insurance

Craftinsure Third Party Only Boat Insurance Updated 2019

Our Third Party Only policy is Plain English and has been specifically designed for Boat owners who want only Third Party Liability Insurance. Cover has been specially written for Third Party risks based in the UK.

- Policy Detail

Benefits of Craftinsure Third Party Boat Insurance

- Specialist Third Party Insurance from the leading online Boat Insurer

- £5,000,000 Third Party Cover

- 20 Seconds to get a Quote

- Damage you do to other boats, pepole and property

- Salvage of your boat from location of loss

- Includes Removal of Wreck

- Minimum level of cover required by Harbours, Marinas and the Canal and River Trust

Useful Links

- Insurance Product Information Document

- Summary of Cover

What is Insured?

- Your legal liability – third party cover to others for injury or damage caused up to £5,000,000, and for liability for removal of wreck for up to £15,000 any one event.

- Cover for others using your boat with your permission

- Legal costs incurred in defending a claim against you

- Removal of Wreck

- Salvage costs

- Minuimum level for Harbours, Marinas and the Canal and River Trust

What is not Insured?

- Loss or damage to the vessel

- Loss or damage to personal effects

- The vessel operation outside of the territorial scope shown in the policy.

- Wilful misconduct or recklessness by you or other persons in control of the vessel (including whilst under the influence of alcohol or drugs).

- Racing or speed trials.

- Sample Policy

Agreement details

- Repair or replacement up to the sum insured stated in your policy

- We will pay the agreed value or replace the vessel after a total loss.

- Loss or damage whilst in transit by road (provided by road haulier if over 30ft/9.14m in length)

- Inspection of the vessel after grounding, even if no damage is found.

Are you sure you want to redirect to Craftinsure Ireland?

Craftinsure Ireland Limited operates solely in the Republic of Ireland, providing insurance to residents of Ireland. It is an independent company with no association to Craftinsure Limited which provides insurance to residents of the UK.

Close this window to stay on the Craftinsure Limited UK website.

Please Check

Basic boat insurance - third party liability cover

Basic boat insurance for sailing enthusiasts.

Third party liability insurance is essential cover for boat owners. It provides protection against claims from third parties for damage to their property or for injury or death that may arise from the use of your boat.

Our features and benefits

- £3,000,000 limit of indemnity

- Cover in all UK and European waters

- Up to £15,000 costs for removal of wreck where it's your legal liability to do so

- No requirement for a survey

- No excess on claims.

Plus a key optional extra, if you need it

- Cover for liability whilst towing water-skiers (on sports boats)

Having basic boat liability insurance such as third party cover is often a requirement for using inland waterways, to launch your boat, or to keep it in a marina.

Get third party boat insurance cover

Buy online today using our quick quote and buy – our experts are always on hand to support you.

93 % of our customers would recommend our service

What's covered in our third party liability insurance?

Simply put, you'll have £3 million cover for all sums that you legally have to pay as a result of owning your boat, including:

- Death or, injury to third parties, including your passengers

- Damage to property owned by third parties

- Cover for removal of wreck where you are legally liable (up to £15,000)

Please note this list is not exhaustive – refer to full policy document for details.

Why choose us for third party boat insurance?

Our team is different because we understand the lifestyle of owning a boat.

Having boat insurance specialists do the hard work for you will help you enjoy your hobby with confidence and peace of mind.

We’re proud to offer:

- 40 years of marine broking experience, backed by the world’s leading insurance broker and risk adviser

- Real people giving you a personalised service

- A diverse team passionate about boats

- A trusted partner of the RYA

- Quality products backed by A-rated insurers

- The flexibility to buy the way you want – online or over the phone

- Access to our friendly team who is always on hand to help, especially if buying online isn’t quite right for you.

Our promise to you

We take third party boat insurance seriously, so you’ll always know you’re in the right hands. We promise to:

- Represent your interests at the time of a claim to get you the very best outcome

- Give proactive risk management advice to protect your boat

- Make it easy to make changes to your cover throughout the year.

Going the extra mile

Our dedicated team loves to answer your questions and go the extra mile wherever they can. And we’re not just boat experts, we’re also experts in:

- Finding solutions to fit clients’ complex needs

- Explaining policy conditions and exclusions so you don’t fall foul of them

- Explaining the risks to new boat owners

- Walking you through the whole process of insuring your vessel.

Still not sure what boat insurance you need?

No problem, we'd love to talk to you - call an expert now.

They quoted a reasonable premium and settled a claim without a quibble. Christopher

Frequently asked questions

Read our latest related articles.

March 07, 2023

7 Point Checklist: Owning a Boat for the First Time in the UK

Have you just purchased a boat? Firstly, congratulations! To help you with the next steps, we’ve pulled together a 7 point checklist of the key things you need to think about.

June 27, 2023

New quote and buy launches for yachts and motorised vessels

Bishop Skinner Marine is delighted to announce it has strengthened its ability to meet the needs of customers with the launch of its online quote and buy facility for yachts and motorised vessels on 12 June 2023.

September 07, 2023

Bishop Skinner Marine team set sail at Blackwater Sailing Club

The Bishop Skinner Marine team recently enjoyed an evening of dinghy sailing on the training lake at Blackwater Sailing Club in some RS Quests. Find out how they got on.

Welcome To Topsail

Boat insurance specialists topsail insurance.

WE HAVE INSURED THE SAILING COMMUNITY THROUGHOUT THE UK AND WORLDWIDE FOR OVER 25 YEARS.

We provide insurance for Motorboats, Yachts, Narrowboats, Inland Craft, Canal Craft, Dutch Barges, Small Craft, Speedboats, RIBs and Sailing Dinghies and more in both the UK and worldwide.

Our specialist Travel Insurance policies, the Yachtsman’s and Tall Ships Travel Insurance can be purchased via our website, with both Single Trip Travel Insurance and Annual Multi-Trip Travel Insurance available for your boating holidays, tall ships voyage or general sailing with your own boat. The Yachtsman’s & Tall Ships policies include cover for sailing outside territorial waters.

We are pleased to have an active involvement with The Cruising Association and also the prestigious Ocean Cruising Club, offering discounts to members.

Topsail Insurance is a dedicated team of boating enthusiasts who are highly passionate and knowledgeable in Boat Insurance and Travel Insurance, with over 100 years of combined experience.

We provide a range of insurance options from a basic boat liability, which covers your liabilities with owning a boat, to a comprehensive marine insurance policy.

Let us compare your boat insurance renewal quote or provide you with a quotation for your new boat insurance. We provide both UK boat insurance but also cover yachts and motorboats sailing worldwide.

Please select your vessel below to learn more and get a quote.

We offer Single Trip Yacht Travel Insurance and Annual multi-trip Yachtsman’s Travel Insurance. Our Tall Ships Travel Insurance product means we have both the Tall Ships and general sailing community covered.

We also have access to alternative travel insurance products for Adventure Travel, and a general travel insurance policy, Travel Plus.

Please select your travel product below to learn more and get a quote.

Contact our team now for a quotation for your touring or static caravan, with high levels of cover available and personalised benefits.

Please select the type of caravan below to learn more and get a quote.

Topsail are proud to partner with a number of respected Marine Organisations and Owners Associations. We are often able to offer discounts and special benefits too. Click the logos for more information.

Towergate together with our parent company The Ardonagh Group are deeply saddened to hear of the death of Her Majesty the Queen. She is remembered by our colleagues and worldwide as a beacon of duty, wisdom and service.

- Personal Insurance

- Business Insurance

- Commercial Drone

- Film and TV Production

- Photography and Camera Equipment

- Photography

- Videographer

- See All Camera Covers

- Care and Medical

- Dental Indemnity

- Dental Nurse

- Domiciliary Care

- Medical Indemnity

- Staff Absence

- See All Care and Medical Covers

- Commercial Property

- Block of Flats

- Business Premises

- Caravan Park and Campsite

- Commercial Property Owners

- See All Commercial Property Covers

- Commercial Vehicle

- Agricultural Vehicle

- Driving Instructor

- Self-Drive Hire

- See All Commercial Vehicle Covers

- DSS Landlord

- HMO Landlord

- Landlord Boiler

- Landlord Contents

- Landlord Home Emergency

- Multi Property Landlord

- Student Landlord

- Unoccupied Landlord

- See All Landlord Covers

- Small Business

- Cyber Liability

- Directors and Officers

- Employers Liability

- HR and Training Consultants

- Product Liability

- Professional Consultants

- Professional Indemnity

- Public Liability

- Self Employment

- See All Small Business Covers

- Beauty Therapist

- Complementary Therapists

- Counsellors

- Talking Therapists

- Hypnotherapy

- Psychotherapists

- Psychologists

- Massage Therapist

- Nutritional Therapist

- See All Therapists Covers

- Trade Specific

- Contractors All-Risk

- Construction

- Professional Indemnity for Trades

- Sole Traders

- Tree Surgeon

- See More Trade Specific Covers

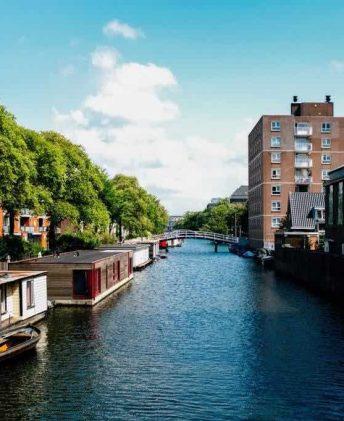

Canal and Narrowboat

Canoe and kayak, paddle board and windsurf.

- Rowing Scull

- Yacht and Catamaran

- See All Boat Covers

- Holiday Lodge

- Static Caravan

- Touring Caravan

- Trailer Tent

- See All Caravan Covers

- Bloodstock and Racehorse

- Horse Trailer

- Horsebox Breakdown

- Livery Yard and Stables

- Veteran Horse

- See All Equine Covers

- Backpacker Travel

- Car Hire Excess

- Coach Travel

- Long Stay Travel

- Over 65s Travel

- Sports Travel

- Travel With Pre-Existing Medical Conditions

- See All Travel Covers

- Home and Property

- See All Home and Property Covers

- Private Clients

- Holiday Home

- Listed Property

- Non-Standard Construction

- Second Home

- Unoccupied Property

- Lifestyle Excess

- Martial Arts

- See All Leisure Covers

- Gurkha Family Medical Expenses

- Military Adventure Training

- Military Contents

- Military Home

- Military Kit

- Military Personal Accident

- Military Travel

- Military Winter Sports

- See All Military Covers

- Classic Bike

- Classic Car

- Disabled Driver

- Learner Driver

- Non-Standard Private Car

- Van Hire Excess

- See All Motor Covers

Yacht and Catamaran Insurance

Sail further with our yacht and catamaran insurance.

- Up to £5 million in third-party liability and racing liability

- 24-hour single-handed use cover as standard

- Get a £40 Amazon voucher when you buy a new policy over £250*

Call us on 0344 892 1987 or get a quote online

*Terms & Conditions - £40 Amazon Voucher offer

A £40 Amazon voucher is available to new customers who purchase a boat insurance policy online where no code is needed or over the phone and quote the code AMAZON40. This offer is subject to an annual price of £250 (including insurance premium tax at 12% and our customer service charge) or above and cannot be used in conjunction with any other offers or discounts. In addition, it is not available on the Towergate Active product for small craft where the annual price paid is under £250. Cover is subject to your individual circumstances and our eligibility criteria. The voucher will be issued to you by email after 30 days on cover. If you cancel before you have been on cover for 30 days, you will not be eligible for the offer. Offer expires on 31/12/2024 but can be withdrawn or amended at any time if it is necessary to do so. Policies purchased after this date will not be eligible for the offer. There is no cash alternative available, and we reserve the right to substitute a reasonably equivalent alternative, of equal value, should circumstances make this necessary.

One of the UK's leading independent insurance brokers

Overall service rating 4.6 / 5

Based on 4457 customer reviews

Why choose yacht and catamaran insurance with Towergate?

Single-handed use of yachts.

Covers 24-hour single-handed use of yachts and catamarans as standard.

£5m yacht liability cover

Be ‘marina ready’ with up to £5 million in third-party liability cover.

Racing liability for yachts and catamarans

Racing cover as standard, with damage to masts and sails as an optional extension.

Pay by Direct Debit

Choose to spread your payment into 10 monthly Direct Debit instalments.

About yacht and catamaran insurance

What does it cover, be 'marina-ready'.

Whatever your yachting style is, you can be ‘marina and race-ready’ with up to £5 million in liability cover. Exclusions include, employees and marine trade workers, fare paying passengers, water skiers, parascenders and divers.

24-hour single-handed use

Our yacht and catamaran insurance policies cover single-handed use. This is the case for up to 24 continuous hours for avid UK sailors. Check our policy wording for more details.

Specialist claims handler

For more complex claims, a specialist handler will be assigned to manage your yacht or catamaran claim. They will carefully lead you through the whole process.

Optional personal accident cover

Our personal accident cover can be added as an optional extra. It may help to pay for medical expenses should you be involved in something a bit more serious. Please be aware that if you’re over the age of 76, you will not be eligible for personal accident cover.

How do claims work?

When you need to make a claim, we'll guide you through the process and get your claim settled as quickly as possible.

- Find your insurance documents and make sure you have all your information at hand, including your policy number.

- Call the claims team for current claims on 0330 018 2292. From 1 Nov, new claims can be reported by calling 01273 863 450 , and explaining exactly what happened

- Provide photos if requested to help us understand what happened as quickly as we can.

Ready to get covered?

- Fill in our online quote form or call us

- Purchase your policy

- Relax - You're covered!

Yacht and catamaran insurance FAQs

What is yacht insurance.

Essentially, yacht insurance aims to protect your craft, other craft on the water and of course, you and your passengers. The idea of insurance is to put you back in the financial position you were in before you experienced a loss of some sort.

This financial loss could come about in the form of damage to your boat, a third party claiming against you for damage to their craft or in the worst case, loss caused by injury to you or one of your passengers.

Towergate yacht insurance covers all the areas mentioned above. Though it isn’t necessarily a legal requirement, many marinas require a minimum of third party cover if you’d like to use their facilities. In any case, it is strongly advised you have insurance in place due to the high value of the yachts themselves and the potential for injury.

How can I get the best value from my yacht insurance?

Moor in a marina - Our policy offers extra benefits for mooring in a marina as mooring at a berth in a marina is typically safer and more secure than a swinging mooring.

Use Smart Water - Mark your equipment with a Smart Water kit purchased using your unique Towergate code and you can receive a further 10% discount.

Get a survey of your craft completed if it’s over 25 years old

Let us know if you have RYA qualifications - We like to reward those who try to develop their own sailing competence as this only makes them safer on the water. Let us know if you have a RYA qualifications and we could award you another 10% discount.

Let us know if you’re planning on racing

Do you offer laid up cover for yachts?

Not all of us are lucky enough to use our yachts all year round. There are likely to be times when the weather is too rough or your yacht is in need of essential maintenance. During these times, you may wish to take your boat out of the water and store it in a dry dock or stack storage.

It's also a strong possibility that your boat will need to be out of the water if you're selling it on. It's a good idea to take it out of the water to allow potential buyers to fully inspect the hull, keel and other components which sit below the waterline.

As well as covering your yacht when it's in the water, Towergate can also apply laid up cover for when it is out of the water and not in use for an extended period. This cover will insure your yacht against theft, damage, vandalism and third party cover whilst it is off the water. It won't cost you any more money, you just need to let us know that you're taking your boat off the water and how long for.

Does this cover come with any exclusions?

It’s very important to read your policy documents in detail, so you understand what’s covered and what could void your cover. Listed below are a few key exclusions you should be aware of. Check your policy document for a full list of exclusions.

- Mechanical failure is not covered if your craft is over three years old.

- Personal accident cover won’t cover individuals over the age of 76 - If you are over the age of 76 the personal accident aspect of our cover will not apply. All cover relating to the craft however, will still apply.

- Wear and tear and mechanical failure are not covered - If your craft is under three years old, we can provide mechanical failure cover. Wear and tear however, is not covered.

- Replacements beyond the sums insured on your policy - Our policy works on a market value basis. Therefore, it’s important to know the true replacement value of your yacht. You will be unable to claim for a replacement yacht above the value you give us. If you’re unsure of the value of your yacht, a marine surveyor will be able to make an assessment and give you an accurate value.

What are the benefits of yacht insurance?

Our yacht insurance comes with a few different options allowing you to get the cover that’s right for your value of craft, level of sailing experience and mooring arrangements. Listed below are just a selection of our best features and how they can benefit yacht owners just like you.

• £3,000,000 third party liability included as standard - The waterways, rivers and seas can be tricky places to travel around on and sometimes mishaps occur. Add to that the fact that yachts and other craft tend to carry a hefty price tag and you’ve got a recipe for some expensive accidents. Our yacht insurance policy includes £3,000,000 third party cover so if you accidently cause damage to someone else’s property whilst on the water your insurance will cover the cost of that damage. • Personal accident cover (optional) - If you enjoy challenging yourself with rough seas and high speeds, we advise you add personal accident cover to your policy. Our personal accident feature will cover medical expenses and emergency treatment. • Protected no claims bonus (platinum level cover) - Take out our highest level of cover to have your no claims bonus protected year on year even if you have to claim (No more than two claims per year). • Marina benefits (platinum level cover only) - If you permanently moor your boat on a marina berth or keep it ashore at the same location, we won’t charge your excess on any claim made while it’s moored or stored. This also won’t affect your no-claims bonus. • Failure of machinery (on yachts less than three years old) - You’d hope that newer yachts wouldn’t have too much trouble with the machinery on-board. Never-the-less, we include cover for this should you be unlucky. • Legal expenses cover - Should a third party bring charges against you for damage caused to their craft or personal injury caused by you, our legal expenses cover can help with your legal fees up to £100,000. • 24 hour legal and claims advice line - In addition to covering legal fees, we also offer legal advice to guide you through what to do if you get involved in a legal dispute. • Travel concierge service - Part of the joy of owning a yacht is the ability to travel to new places. The travel concierge service can arrange; local hotels, restaurants, theatre tickets and more.

I have some expensive equipment on-board. Will this be covered on and off the water by my yacht insurance policy?

Our yacht insurance covers a number of items, including things you’d carry on your person such as digital compasses or pocketknives. These smaller items do have a single article limit of £300. However, you can also cover more expensive items such as on-board GPS equipment and outboard motors. All you need to do is let us know what you’d like covered so we can include it in your sums insured. Please let us know if you would like to cover any items over the £300 single article limit.

Are there any restrictions on my cruising range?

Unfortunately, we can’t cover you in the Caribbean or the Baltic seas, though we can sometimes refer this to our underwriters. As a rule, we do not cover any cruising more than 35 degrees east in the Mediterranean. Again though, you’ll need to let us know if you want to change your cruising range from what you originally agreed when you set up your policy. See the question below for more detail.

If I need to make changes to my yacht policy, can I do this halfway through the year?

Things never stand still in the world of boating. So, if you’ve installed the latest gadget and you need your sums insured amended or you’ve changed your mooring arrangements or cruising range, give us a call and we’ll update your policy. There is an administration fee charged to change the details on your policy plus any premium increase related to the additional cover you require.

Do I need to get my yacht surveyed?

If your yacht is over 35 years old, we will require proof that you’ve had it surveyed. Furthermore, we will require your craft to have a survey every 10 years thereafter. For yachts under 35 years, no survey is required for you to take out insurance.

Can I get third-party liability cover for older yacht and catamarans?

Yes, we also provide liability for those actively using older yachts or launching onto the water. This third-party cover product includes the removal and disposal of wrecked craft, as well as the re-floating and removal of damaged craft.

How do I qualify for discounts on my yacht insurance premium?

In some ways, yacht insurance works like car insurance. If you’re an experienced sailor, your premium might work out cheaper. Contact us to see if any discounts apply.

Can I pay in instalments?

If you would prefer to spread the cost of your yacht and catamaran insurance policy, you have the option of setting up a Direct Debit to pay your premium in monthly instalments through our preferred provider, Premium Credit Limited (PCL).

To find out more about PCL and direct debit payments, select Direct Debit . To understand more about how PCL work together with Towergate, please read our Regulatory Information .

Where can I find full details of my policy?

We have provided a summary of the key features of the policy, above. For details of the terms and conditions applicable, please refer to the insurance product information document and policy wording, which are available during the quotation process.

Why choose Towergate?

We are a specialist insurer who keep our finger on the pulse of the boating world. Our boat insurance teams are trained to find the right cover for you and we feel our combination of flexible insurance and a helpful customer service, will ensure you're covered correctly and be a huge comfort every time you take to the water.

Should you need to claim, we will guide you through each step of your claim and advise you on how to gain a swift resolution. It's our aim to take the stress out of what's often an already stressful situation. Simply give us a call and we’ll take it from there.

See our range of cover

Yacht and catamaran insurance articles, guide to boat security.

A guide to boat security devices you can buy to help keep your boat and its contents safe, as well as some of the options you have for storing your boat.

Guide to Buying and Owning a Yacht

All you need to know about buying and owning a yacht, including costs and maintenance.

Preparing Your Yacht for the Sailing Season

It is crucial to prepare your yacht for the start of the new sailing season to avoid costly repair bills and inconvenience. Read our tips on how to keep your yacht in top condition.

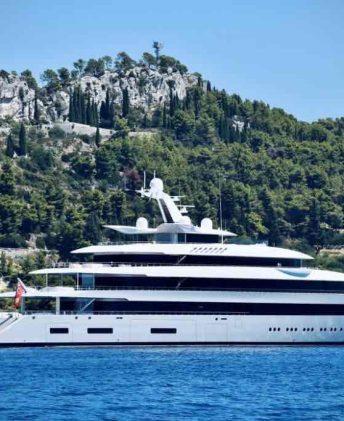

How Much Does a Super Yacht REALLY Cost?

This infographic gives you the low down on the most expensive yachts, who owns them and how much they cost to run.

Yacht owners' gadget guide

The best sailing and yachting gadgets on the market today. From simple yet effective gift ideas to the flashiest bits of kit on the water.

- [email protected]

- 01684 564 457

- Customer Login

- Renew Online

- Make a Claim

Third Party Boat Insurance

We offer both fully comprehensive and third party options on all our boat insurance policies. Whilst we simply don’t do cheap boat insurance (we only offer genuine quality products) we can guarantee that if you are looking to purchase a low cost boat insurance product but are less concerned about protecting your own vessel our third party liability only boat insurance policies are the perfect choice!

Listed below are the standard policy attributes you’ll benefit from with any of our third party policies and be confident that when purchasing any boat insurance policy through us you’ll always get dealt with efficiently and effectively by UK based staff.

Policy Highlights

Listed below are the policy highlights we offer as standard to for third party boat insurance policies;

- Competitive boat insurance quotes as standard

- All policies underwritten by excellent insurers

- Either £2 million or £3 million worth of insurance cover

- Optional Legal cover

- UK only staff, no automated calls & never any junk mail!

Please Click GET QUOTE to receive either a Quick Indication or a Formal Quotation.

- Boat Insurance

- Boat Travel Insurance

- Canoe and Kayak Insurance

- Dinghy Boat Insurance

- Hovercraft Insurance

- Houseboat Insurance

- Inland Craft Insurance

- Jet Ski Insurance

- Motorboat Insurance

- Sailboat Insurance

- Sailing Dingy Insurance

- Small Craft Insurance

- Speedboat Insurance

- Yacht Insurance

- Get a Quote

Compare Boat Insurance

Make sure you’re getting the best deal on your boat insurance. compare the market against some of the uk’s leading insurers., boat insurance specialists, we have partnered with the leading boat insurers in the uk to give you the most competitive quotes available on the open seas., sail abroad.

Choose between third party and comprehensive cover and sail overseas too

No Claims Discount

Get the best rates with Taylor Watkins including a no claims discount

Same Day Quotes

Get insured in 24 hours and sailing the seven seas in no-time

Compare Boat Insurance That Suits Your Needs

Should anything go wrong, your vessel and everybody on board are fully covered by a trusted insurance policy..

Boat insurance is an important part of owning, renting or using any kind of boat, from jet skis, yachts and motorboats to speed boats and hovercrafts. Making sure you have the right cover means that should anything go wrong or anything untoward happen, you and everybody on board are fully covered by a trusted insurance policy.

Taylor Watkins can help you find the right insurance cover for all types of boats in the UK and we help you choose the policy that is best suited for you and your prized boat. Rather than having to chase various insurers to compare many quotes, we are able to provide easy access to a whole host of insurers for all nature of boats and vessels.

Cover is available for anyone in the UK who is making use of a water vessel and anyone who owns a boat. The process is totally secure and our website is encrypted to secure all of your data. Our service is also 100% free of charge. We don’t make our money from our customers. However, we may receive a fee from the insurer. Additionally, we promise to never sell or give out any of your details to any third parties.

“Boat Insurance Compare gave me a number of different policy options and helped my insure my sailboat at the most reasonable price. Now I have peace of mind that I can take my family on holiday this summer and not have to worry about any liabilities.” Jim, Devon

Types of Boat Insurance from Taylor Wakins

As featured on:

We are able to provide all different levels of cover for your boat, whether it is for leisure or business purposes. Whilst having insurance in place is not a legal requirement, it can give you peace of mind knowing that you are safe in any circumstance.

Third party is the minimum cover you can purchase and this will protect any other individuals or vehicles that you come into contact with when using your boat. This will not cover any damages to your own vehicle or to the people on it as this will require additional cover.

After third party cover, the next level up will provide compensation for fire, flood, theft and damages. If your vehicle or key parts have been stolen, you will be able to claim for new parts or a replacement.

You will automatically be insured to cruise in the UK, Republic of Ireland, European and Mediterranean waters, but sailing outside of these areas may require additional cover depending on the insurer. (Source: Gov.uk )

Accident cover is available for any occupiers of the boat and your insurer will pay for any potential medical bills, legal fees and loss of income.

Liability cover allows you to pay compensation for any damages that you may be liable for towards members of the public or any crew on deck.

For salvage cover, your insurance will pay the costs to find any lost parts of the craft, which will minimise the need to pay for replacement parts.

Latest Articles From Our Magazine

Is My Boating License Valid in Other States?

8 September 2021

The Pros And Cons Of Living Aboard A Boat

7 November 2023

7 Boating Excursions Around The World To Explore

6 most memorable fly fishing trips in the us.

Do I Need to Register My Boat to Use it at Sea?

21 March 2023

Things To Do Before You Set Sail

22 October 2021

What Does General Boat Insurance Cover?

21 October 2021

How To Prepare Your Boat For The First Trip Of The Season

20 October 2021

What To Consider When Choosing Your Marina

15 October 2021

How To Take Care of Your Boat As Temperatures Drop

Useful Storage Ideas For Living On a Narrowboat

Can You Live On a Canal Boat?

22 September 2021

How Much Does it Cost to Buy a Yacht?

Can I Moor & Anchor My Boat Anywhere?

When Is The Best Time To Buy a Boat?

24 January 2021

Boat Rules You Need To Be Aware Of

18 August 2021

Things To Consider When Naming A Boat

Which Boat Is Right For Me?

11 August 2021

How Much Does It Cost To Run A Boat?

9 August 2021

How Much Does Boat Insurance Cost?

24 February 2021

Pros and Cons of Living on a Boat

26 January 2021

Tips for Living on a Narrowboat

Do I Need Motorboat Insurance?

Are Boats Covered Under Home Insurance Policies?

What Determines the Price of Boat Insurance?

Do i need yacht insurance.

The Benefits of Boat Insurance

What Does Motorboat Insurance Include?

Useful links, we are currently not accepting any new applications., please feel free to use our guides and educational resources. we will update you soon.

- Get A Quote

B o at insurance specialists

Noble Marine has been providing a personal and professional service to marine insurance customers for over 30 years.

Policies and claims are dealt with in-house by our knowledgeable staff giving exceptional levels of service. Get a quote online for your boat insurance today.

get a quote

From surfb o ards to racing yachts

Quote and buy online or call us on 01636 707606, quote and buy online or call us on 01636 707606.

Noble Marine Insurance are a specialist boat insurance provider with over 30 years experience in insuring everything from surfboards to £1m racing yachts.

Our marine team has decades of experience that has allowed us to develop our own policy wordings tailored to the specific needs of the varied types of craft and users. This enables us to cater for everything from standard craft to the more unusual and specialist craft.

All our claims are handled by our own, in house, team. This means that we can settle claims quickly and we can also help you find a suitable repairer if you need us to.

Whether you own a single boat or multiple craft of different types, we can cover them all on a single policy to keep all your marine insurance in one place, keeping it simple and saving you money with our 12.5% mulit-boat discount (up to a maximum of £150 per policy).

Noble Marine Insurance has been an enthusiastic supporter of sailing at all levels since we were founded as a dinghy insurance broker, we are still highly committed to the sailing community and we sponsor over 25 class associations as well as numerous sailing events throughout the year.

We offer a great on-line service but if you would prefer to arrange your policy over the phone we are always delighted to speak to our customers.

Boat Insurance FAQs

What is boat insurance?

Most importantly, boat insurance will provide you with third party liability cover if you were to cause damage to other people’s property or injury to another person.

In addition Comprehensive boat insurance can provide you with financial protection if your boat is involved in an accident, stolen or damaged by fire or storm.

Do I need boat insurance?

Boat insurance is not actually a legal requirement in the UK however most marinas, harbours and in recognised mooring areas require evidence of third party boat insurance. Most lakes and reservoirs require the same, and you will need to produce proof of third party boat insurance to obtain an inland waterways licence. Also most organised events such as racing will require evidence of liability cover.

In addition to third party liability cover most people will want to insure their boat for damage including from fire or theft to protect their investment and ensure that they are able to stay on the water as much as possible. Noble Marine Insurance can insure boats up to a value of £750,000.

What does your boat insurance cover?

It is important to make sure that your boat insurance is adequate for your needs, and not to forget additional equipment such as trailers, trolleys and safety equipment that can be easily overlooked and are often costly to replace. Most accessories and equipment that is specific to your boating activities can be covered by boat insurance if you opt to include them. Noble Marine’s boat insurance will usually cover:

- Accidental Damage

- Fire or Explosion

- Theft or Attempted Theft

- Malicious Damage / Vandalism

- Storm Damage

- Your liability for damage or injury to other parties

Boat insurance policies generally do not cover:

- Wear, tear, depreciation, gradual deterioration e.g. corrosion or electrolysis

- Mechanical breakdown

- Damaged deliberately caused by you

- Faulty workmanship

For full details of Noble Marine’s Boat Insurance cover and exclusions please click here for a copy of our policy wording and Insurance Product Information Documents.

Are there any conditions of my boat insurance?

It is also a condition of many boat insurance policies that your boat is maintained correctly and in a seaworthy condition. Whilst it is important to ensure your boat insurance policy will be valid in the event of a claim, this is also good practice to ensure that you and your passengers and/or crew are safe when on the water. It is important to ensure that all systems of a boat are checked and, as necessary, maintained in accordance with manufacturers guidelines or generally acknowledged best practice. If you are unsure it is worth getting professional advice from a yard or surveyor.

How much will my boat insurance cost?

This depends on the type of boat, who’s using it, where it is being used and what it's being used for. Prices start from around £40 per year.

What types of boats do you offer boat insurance for?

Noble Marine can provide boat insurance for most types of pleasure craft including:

- Canal boat Insurance

- Canoes Insurance

- Dinghy Insurance

- Jet Ski Insurance

- Sport Boat Insurance

- Motor Cruiser Insurance

- Motorboat Insurance

- Narrowboat Insurance

- Paddleboard Insurance

- RIB Insurance

- Rowing Boat Insurance

- Sailboard Insurance

- Speedboat Insurance

- Surfboard Insurance

- Yacht Insurance

What if I want to insure more than one boat?

Most boat insurance policies only allow one boat per policy, however Noble Marine’s policy allows you to insure all your boats from canoes and paddle boards to dinghies and yachts under the same policy, you will also benefit from a 12.5% Multi-boat discount (up to £150 per policy).

Does your boat insurance cover me abroad?

If your boating adventures take you to more distant shores or you are involved in racing abroad, then Noble Marine Insurance can provide a solution to meet these needs in most circumstances. We can also extend the policy to include boats that are Skippered Charter.

Just call us to discuss your requirements and we will help you through the process or enter your details online by clicking ' Get A Quote ' and we will get back to you.

Please note that policy cover is subject to the terms and conditions of our Marine Insurance Policy .

Do you offer boat insurance for racing?

Racing cover is included as standard on all of our dinghy, sports boat, rowing boat, canoe, kayak, surfboard, sailboard and paddleboard policies.

We also offer racing cover for sailing yachts, this may be at an additional charge depending on the type of racing you’re doing.

For full details of Noble Marine’s Boat Insurance cover and exclusions please check our policy wording and Insurance Product Information Documents .

Can I transfer my boat insurance to a different boat?

If you sell your boat and replace it with a new or different boat then you can keep the same policy and simply swap them over.

Your claims are handled by our own in house experts.

Noble marine is a trading name of noble insurance services ltd who are authorised and regulated by the financial conduct authority. firm reference number 305884..

How much is Yacht Insurance in the UK

If you are a yacht owner or looking to become a yacht owner then one of the most important things on your list will be yacht insurance and how to ensure that the policy you sign up for fits both your sailing plans and your budgeting requirements.

Is it a legal requirement to have Yacht Insurance in the UK ?

The type of Yacht Insurance you need depends entirely on how you intend to use your yacht and where. There is no legal requirement to have yacht insurance. However, an increasing number of local authorities and marinas insist upon a minimum level of third party liability insurance. For example, you will need a minimum of £1 million third party liability insurance prior to registering your boat for use on inland waterways and usually £3 million at most marinas.

For more information on owning a boat, statutory certificates and safety requirements at sea we suggest you visit the Owning A Boat web pages on the UK government website. Alternatively, why not contact our specialist team for advice on obtaining yacht insurance that reflects your needs. That way you will obtain the best possible cover at a competitive premium to cover your sailing plans.

When buying a Yacht when should I purchase Insurance?

We would advise that you have yacht insurance in place prior to taking a financial interest in the yacht or when the sea trials have been completed and the boat is handed over, in the case of a new boat. Even if you have no immediate plans to take your new pride and enjoy for a sail, it will be at the mercy of both the weather and other people’s carelessness.

What information will I need to provide for obtaining a Yacht Insurance Quote ?

When obtaining a Yacht Insurance Quote for either a yacht that you already own or one that you are planning to buy, you will need to have the following information to hand:

- All your personal details and contact information

- Full details of people in charge of the yacht including experience, previously owned boats, sailing qualifications and any claims.

- Details of the yacht including model, value, age etc.

- Engine manufacturer, horse power, maximum designed speed and type of fuel.

- Details of the use – private, corporate entertainment or charter

- Value to be insured. This should be market value or price paid

- Details of the mooring and the location and planned cruising within the first year of the insurance policy.

- And, finally the date of when you would like the yacht insurance policy to commence.

How to reduce the risk and yacht insurance premium cost

Just like any other insurance policy, your yacht insurance premium cost will depend on the level of risk, i.e. where in the world you intend to sail her and how she is secured. Here are a few top tips from our experts at Admiral Yacht Insurance on reducing risk:

- Before you buy a second hand yacht make sure you arrange for a full out of water survey by an independent surveyor.

- You are also advised to have the rigging checked. If the rigging is more than 10 years old it should be replaced and you therefore need to factor this into your offer.

- Ask for an alternative quote with a higher than normal excess, as comparison, as this will reduce the premium.

- Never insure for a larger cruising area than you need. If you are not sure you can always ask for an option to extend the cruising area for an additional premium.

If you would like more information on keeping your yacht insurance costs to a minimum or require advice on the type of insurance cover you will need, and an indication of cost, prior to buying a yacht please Contact Our Team of experts who will guide you through the process.

Admiral Marine is a trading name of Admiral Marine Limited which is authorised and regulated by the Financial Conduct Authority (FRN 306002) for general insurance business. Registered in England and Wales Company No. 02666794 at Beacon Tower, Colston Street, Bristol BS1 4XE.

If you wish to register a complaint, please contact the Compliance and Training Manager on [email protected] . If you are unsatisfied with how your complaint has been dealt with, you may be able to refer your complaint to the Financial Ombudsman Service (FOS). The FOS website is www.financial-ombudsman.org.uk

Boatbuilders

Useful links, yachts & boats we insure.

+44 (0)1722 416106 | [email protected] | Blakey Road, Salisbury, SP1 2LP, United Kingdom

Part of the Hayes Parsons Group

- Renew Your Policy

- Make A Claim

- Your Policy

Start a New Boat Insurance Quote

With over 195 years of experience, GJW Direct provides industry leading boat and craft insurance that gives you peace of mind. Get your UK boat insurance quote online today or call us on 0151 473 8000

Yacht & Sailing Boat

Find out more, motor cruiser, narrowboat & barge, personal watercraft & jet ski, canoe, efoil, rowing boat, sup & windsurfer, marine insurance for leisure boats, how our boat insurance cover works.

GJW Direct can provide you with the perfect cover for your vessel, with instant online quotes available. Each of our policies is different, but as standard we provide:

- 24 hour staffed emergency claims helpline

- Protected no claims bonus

- Exclusive Discounts within your MyBoat portal

Why Choose GJW Direct

GJW Direct are the UK’s leading direct boat insurance company. We’ve been providing Boat Insurance and Marine Insurance for over 195 years. Our range of comprehensive policy options covers engine, trailer and third-party damage – with cover available in UK and European waters.

- +44 (0)1732 223 650

- Make a claim

- Get a Quote

- Login/Renew

We’re proud to say our boat insurance is among the best in the business. We cover many different types of vessel, so you’re sure to find the right cover for your craft.

Protect your barge from waterway mishaps with our top-notch boat insurance policies. Go for ‘Base Layer’ if you just want third party protection, and ‘All Weather’ for comprehensive cover.

When your boat is your livelihood, the stakes are very high, so it’s crucial to choose the right insurance. Discover our Commercial ‘All Weather’ policy, created especially for business boats like yours

Whether you use your dinghy for racing or recreation, you’ll want to know you’re fully covered when you set sail. Check out our policies and see what floats your boat.

When you own an inland cruiser, the world’s waterways are your oyster. But it’s best to plan for the unexpected, as even on a day trip, anything can crop up.

At Haven Knox-Johnston, we’ll help you make lighter work of insuring your motorboat. Check out our policies, and why not get a free motorboat insurance quote today?

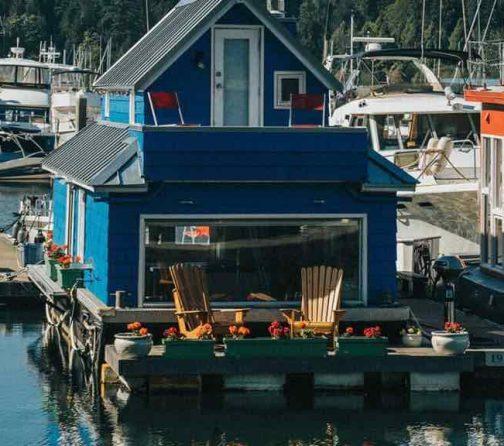

Whether your houseboat is a place you call home, or holiday getaway, we’ve got you covered.

Variety is the spice of life, and for narrowboat owners, that’s especially true. So you’ll want boat cover that’s flexible enough for whatever crops up, from a team that really knows the ropes.

Whatever you use your RIB for, one thing’s certain – your boat insurance needs to be as hard-working as your boat. And when you take a policy with Haven Knox-Johnston, rest assured it will be.

These boats are all about excitement – and when you’re insuring your speedboat, you need cover that can keep up. That’s where we come in. Why not get a quote today?

You can’t beat the yacht life, but it’s no secret it’s not the cheapest of passions. With our in-depth knowledge of the yachting sector, we’re perfectly placed to protect your price and joy.

Nice to see you – hope all’s well.

Non EEA Customers can renew their boat insurance policy with Haven Knox-Johnston

Need to make a Claim? please complete the form and attach any information

Share the love and refer us to your shipmates. If they jump onboard, then you will both receive £20 Amazon Voucher!

Boat insurance with benefits

All your boating questions answered

What it means for you

News, true stories and expert insights from the HK-J crew

Find out what we stand for

Throughout our history, we’ve never stood still

The insurance crew who really care.

Your first port of call

Want to know a little bit more about our Gold standard services? Just click through to see what our customers say about us!

The star of the high seas

Boat Events not to miss

Overview of the Round the Island Race event

Overview of the Crick Boat Show event

Southampton International Boat Show event

Ian and his crewmate, Pete from ‘Haven KJ Enigma’ are attempting to complete the challenging MailASail Azores and Back race.

Find out what else we can shipshape for you!

Fancy some great quality home insurance? Then look no further, we have access to some great products including home insurance.

Get finely tuned Musical Instrument insurance with a 10% discount for the HK-J community

Protect your other prized possessions from the unthinkable. Welcome to Howden Private Clients

At Haven Knox Johnston our broker partners are essential to our future and we look forward to continuing to offer great products, excellent service and competitive terms to help you look after your clients.

What does third party boat insurance cover?

What is a third party boat insurance policy? Inherently it is an insurance policy which can be taken out to provide a basic level of cover, which may satisfy the minimum requirements to comply with the rules and regulations governing parts of our coastal and inland waterways.

It is designed to offer a policy option for boaters who are happy with the minimum level of protection required should they harm a third-party vessel or person. It’s a simple, bare-bones policy designed, as named, to protect others and their property, around the insured and it’s worth noting that cover may not necessarily include removal of wreck and salvage charges. However, every insurance company has the option to add extra cover inclusions to a policy as they feel appropriate, to add to the potential appeal of their policy. It should almost go without saying that making additions and amendments need to be communicated in a clear fashion to the policy holder. Any reduction in cover must legally be communicated with policy holders as a matter of course. It cannot be hidden in wording and just glossed over; it has to be clearly notified at the point in time that policy wording changes.

Any insurance company worth their salt (and in compliance with FCA guidelines) will have clear guidance on what the policy covers and what it doesn’t. This is sent in the form of a full policy wording document, as well as in a succinct manner in the form of an IPID (Insurance Product Information Document). Both should be included within the quotation and the policy documentation received by the customer upon purchase and insurance companies will recommend for the customer to read through the provided information carefully, to make sure the cover on offer/requested is suitable for their purposes. Most insurance provider’s websites will have a copy of the wording to download and read at any time before the policy is taken out. With regards to renewals, insurance companies are required to send out reminders with any cover changes noted and advise customers to review the changes prior to taking up the cover. This is usually done 30 days prior to renewal.

When it comes to a requirement for a survey, it is common for boaters purchasing a third party only policy, or equivalent, that a hull survey will not be required as the insured’s hull itself is not covered by the policy. Once a policy has been taken out, an insurer cannot modify the terms and conditions, or ask for further information without communication with and acceptance by the client

The fundamental basis of the insurance claims process is ‘to act as though uninsured’. i.e. do everything you would to ensure the minimisation of further damage to your vessel and the environment around you. Boaters should act as though there is no security blanket in place and make sure the vessel is as secure as it can be. A third party should only be involved in this process with the agreement of your insurance company. The insurance company can only deal with the customer, or someone who has been authorised to speak to them.

During the boat insurance policy purchasing process it is fine to approach each insurance company or broker with questions regarding any element of cover. It makes sense to create a comparison table to figure out the best cover option and most boat insurance businesses will be happy to help in any way which aids an informed decision with accurate information.

A boat insurance purchasing decision should be made with a full comprehension of what is and what is not covered, and insurers are duty bound to ensure this is the case. The FCA has created consumer friendly regulation which offers huge protections in the case of ‘Mis-selling’ or not having enough information at the time of making the purchasing decision. All UK companies are bound by FCA regulations and must always act in the best interests of customers.

It is worth keeping in mind though that it is up to each individual customer to choose the level of cover they require. Choosing third party insurance can be a risk. A boat owner can increase insurance cover to include a variety of extra additions on top of a base policy, it will just cost more in premium to cover the increased risk.

For your Insurance enquiries call us:

For an online quotation:.

Boat insurance, shipshaped around you

Useful Links

- Terms of Business Agreement

- Cookie Policy

- Gender Pay Gap

- Modern Slavery Act Statement

- YouTube Channel

- Privacy Policy

- Terms and Conditions

- United Kingdom*

- Monaco (GmbH)

- Monaco (SAM)

* Pantaenius UK Limited is authorised and regulated by the Financial Conduct Authority (Authorised No.308688)

- View and download your Policy Schedule(s)

- Check and change your personal details

- Pay your premiums

Boat Insurance

Introducing one of the uk’s leading boat insurance specialists.

For more than 50 years, Pantaenius has been one of the leading boat insurance specialists providing flexible and comprehensive cover for sailing boats and motor yachts of all shapes and sizes. Your boat insurance is tailored from a range of options between comprehensive products to meet individual sailing and powerboat requirements. Because we know that sailing and boating isn’t reserved for office hours, we offer our own in-house 24-hour emergency claims line for emergency assistance. Pantaenius will always be ready to help and guide you if something goes wrong!

Insure your boat

Find the right insurance for your boat in just a few steps. Getting a quotation is easy: Simply complete our online enquiry form and leave the rest to us.

Pantaenius Boat Cover – What is included?

All risk clauses.

All Risk policy based on an Agreed Fixed Value, covering hull, machinery and tenders.

Excess Free Claims

No policy excess on a variety of Hull claims including inspection after grounding, salvage and wreck removal, emergency accommodation, towing and assistance any many more.

24/7 Emergency Claims Helpline

24 hour, 365 days per year emergency claim helpline operated by our own in house staff with no use of outsourced call centres.

Emergency assistance and towage

Cover for emergency assistance and towage included as standard with no excess applied.

New for Old

New for old cover included as standard on parts and materials less than 3 years old.

Agreed Fixed Value

Agreed Fixed Value hull policy which, in the event of a total loss claim, cannot be challenged or averaged.

Skipper Liability included

Third Party Liability policy extended to cover the policyholder when skippering a borrowed or chartered motor boat or sailing boat.

Personal Effects

Cover for Personal Effects included as standard.

Boat Insurance For Your Vessel:

Request your personal quotation from pantaenius today.

Are you looking for the ideal boat insurance coverage? As one of the UK‘s leading boat insurance specialists, we provide both flexible and comprehensive cover for all varieties of vessels – including all shapes and sizes. We use carefully selected insurers, thus being able to offer the perfect boat cover to match your needs. To receive a quotation, simply fill out our enquiry form – we will take care of the rest for you!

Request a quote

Do I Need Boat Insurance?

Insurance is about protecting yourself against the unexpected. You will have no doubt made a sizeable investment in purchasing your boat an to damage it without insurance could leave you financially unable to repair or replace it. Boat insurance provides you with the peace of mind of knowing that you are protected from the financial costs resulting from an accident, because your insurance will pay for possible damage.

So, what about when your boat is out of commission – does your boat still need to be insured then? You’d be surprised to learn how many claims occur whilst vessels are left unattended. Whilst the risks to a boat laid up are different from the potential risks when afloat there are still risks to your vessel for example lightning, storm, fire, vandalism and theft to name but a few.

You will also find that it is a requirement of many local authorities and marinas that, to use their mooring facilities, you must have a minimum of third party liability insurance in place.Pantaenius‘ competitive Hull Insurance, on the other hand, covers you for damage to your own boat. As one of the main types of leisure marine insurance policies available, it covers a broad range of damage to a boat’s hull, machinery and equipment.

What Kind of Boat Insurance Do I Need?

As experienced boat insurance company, Pantaenius offers market leading boat cover and a dedicated Third Party Liability Insurance, both of which offer comprehensive cover without unclear exclusions. Additionally, Pantaenius can offer dedicated personal accident cover (including emergency medical expenses and search and rescue) to provide peace of mind for both owner and crew while on the water.

If you plan to employ crew, you can also call upon the Pantaenius dedicated crew products, tailored to cover your liabilities as an employer and the Crew Accident Insurance and Crew Medical Insurance. When making a comparison of boat insurance policies, whilst price is an important it shouldn’t be the only factor you consider. You’ll need to look carefully: That seemingly low premium for your cover may not be all it seems and you may not protected when you really need it.

Established in 1970, Pantaenius covers over 100,000 boat owners worldwide who enjoy the peace of mind that adding our unique and comprehensive policy to their lives provides. Do you have any questions? We are happy to advise you!

Get a quote

THIS IS HOW EASILY YOU CAN RECEIVE YOUR BOAT INSURANCE QUOTE FROM PANTAENIUS

Step 1: your boat type.

To offer you an individual boat insurance quote, we need to know certain information about your vessel. Please complete the manufacturer, shipyard, model or boat type sections in our boat search engine. Then, select your boat. If no results are returned, you can also fill in these details manually.

Thanks to our extensive database, we will be able to fill out your remaining boat specifications automatically. Please review the details and check that everything is correct, making any changes where necessary.

Step 2: additional information

Please provide us with the additional information we need to provide you with an accurate boat insurance quote, such as onboard equipment and the boat’s value. These are important factors and they form the base starting point for your Fixed Value policy, which is the figure paid to you in case of total loss. The intended use of your boat and where you plan to cruise in the coming year of insurance will also influence the premium, policy conditions and cover offered so please check that the information shown here is correct as well. Information regarding your sailing experience may include both time on the water and any sailing qualifications.

Step 3: personal information

Next, please fill in your personal information. Please provide us with the boat owner‘s full name, your insurance history and also your email address, as your personal boat insurance quote will be emailed to you.

Step 4: summary

You will now see a summary of all information provided by you. Please double check everything and tick the check box at the end of the page to confirm. Finally, hit ‘Submit’ to transfer the information to us and apply for your unique boat insurance quote!

Step 5: receive our quotation

We aim to complete quote applications within 48 hours, and our specialists will send you your competitive insurance offer by email or via our online portal using your personal login. If you have any questions regarding your insurance quotation, give us a call! A friendly and knowledgeable member of our New Business team will be happy to help.

Do you have any further questions? Why not get a boat insurance quote or give us a call if you wish to discuss your boat insurance requirements. Our dedicated staff are happy to help.

Monday to Friday, 9:00 until 17:00

of experience guarantee an exclusive service approach and the most efficient claims management when you need it most.

already place their trust in us and make Pantaenius the leading yacht insurance provider in Europe.

in our network help us deliver true local service and support you with advice and expertise all over the world.

We will help you to find the right insurance solution for your personal needs.

Request your no obligation quote easily and quickly online.

Our experienced staff are available 24 hours a day and always at your side in case of emergency.

Don't hesitate to contact our service team. We are always happy to assist.

- Sustainability

- The Ripe Guarantee

- Refer A friend

- Insure4Boats /

- Sailing Yacht Insurance

Sailing Yacht Insurance

We provide cover for Sailing Yachts and our policies can be completely tailored to you, so you only ever pay for the cover you need. Better still, we offer a Lowest Price Guarantee , which means you can be sure you’re getting the best value insurance for your Sailing Yacht.

Get a Quote

About our cover:

- Build your own policy so you don’t need to pay for cover you don’t need

- Quickly select your European mooring location if your Sailing Boat is permanently moored in Europe

- £3 million Third Party Liability included as standard with all policies

- Sail the inland and coastal waters of the UK and Europe, exclusions apply

- Our cover extends to any person in charge of your Sailing Boat, with your permission

- Up to 25% no claims discount if you’ve made no claims in the past 5 years

- Up to 15% discount if you moor your boat in a recognised marina

How much is Sailing Yacht Insurance cover?

The cost of your Sailing Yacht Insurance will vary, depending on a number of factors, including; the type of cover that you opt for, the maximum speed of your boat, its value, its age, the mooring location of your Sailing Yacht and your own age, marine experience and claims history.

What type of Optional Extras are there to choose from?

Increased standard Third Party Liability cover

Increase your standard Third Party Liability cover from £3 million to £5 million for just £40 plus IPT (insurance premium tax).

Personal Accident

This will cover you, or any passengers, up to £20,000 in compensation following a serious injury whilst using your boat or craft.

Personal Effects

Protect your personal possessions against theft loss or damage whilst on board your boat. Excludes valuables such as jewellery, cash and mobile devices

European cover

Up to 60 days cover at any one time for inland and coastal waters of Europe

Winter cover (for coastal waters only)

Our standard policy will cover you on coastal waters from the 1st April to 31st October. If you sail outside of these months (1st November to 31st March), Winter cover is essential. If your boat is used on inland waters only, you’re covered all year round as standard.

Frost cover will protect your boat should you experience loss or damage as a result of frost or freezing.

Although damage caused by war, strikes, terrorism and other associated risks are rare, the damage caused can be severe. Protect your boat against these risks by adding war cover to your policy.

Cover options

Our flexible policies mean you can choose from two simple cover options depending on the type of insurance you need, and then add the optional extras you require.

Boat (Hull & Machinery) & Third Party Liability

This option will cover your boat against theft and damage, as well as covering you for salvage charges. It also covers your legal liability if you damage another boat or property, or injure another person.

What’s included in this cover?

- Theft of your boat or craft

- Accidental damage caused by fire, explosion, collision, standing, grounding and heavy weather

- Accidental damage caused by negligence

- Malicious damage to your boat or craft

- Salvage charges and expenses in preventing or minimising damage to your boat or craft

- Accidental damage caused to another boat or property, or injury to another person

- Legal costs incurred as a result of damage to a third-party boat or property, or injury to a third party person

- Cover extends to any person in charge of your boat with your permission

- Option to increase standard Liability cover from £3 million to £5 million for £40 plus IPT (insurance premium tax)

Third Party Liability only

Third Party Liability only cover protects you in case you cause damage towards another boat or property, or injure another person whilst on the water.

- Legal costs incurred as the result of damage to a boat or property, or injury to a person

- Accidents incurred when another person is in charge of your boat or craft. Cover extends to any person in charge of your boat with your permission, exclusions apply

Why insure your Sailing Yacht with us?

We provide cover for a Sailing Yachts between 27ft - 50ft, and our policies can be completely tailored to you, so you only ever pay for the cover you need . Better still, we offer a Lowest Price Guarantee , which means you can be sure you’re getting the best value insurance for your Sailing Yacht.

Our insurance policies include local club racing only, as standard . So, if you take part in club-organised races in your Sailing Yacht we’ll cover you for races that take place at your club, as well as those organised by other local sailing clubs. Cover includes both B oat (Hull and Machinery) and Third-Party Liability options , plus you could qualify for up to 25% no claims discount and up to 10% marina discount.

Check out some of our great reviews...

Sign up for our latest news and offers.

To receive exclusive offers from Insure4Boats and the Ripe Group plus the latest boating news and information, please complete your details below.

Please enter a valid email address.

Please select your boat type.

Please confirm your preferences by selecting from the options below.

Your data is safe with us and you can unsubscribe at any time. For more information, please see our Privacy policy

We also work with a few, carefully selected retail and leisure partners. Please click below if it’s ok for us to send you offers and information from these partners from time to time.

Yes please , I’d like to receive partner news and offers from Ripe

No thanks, I don’t want to receive partner news and offers from Ripe

Thank you for subscribing, you'll be hearing from us soon!

Got a question?

0800 668 1661

Call our FREEPHONE UK call centre

Award-winning insurance

Insure4Boats is a Ripe Insurance Services product

Check out our other products:

Sports Insurance

- Golf Insurance

- Cycling Insurance

- Shooting Insurance

- Extreme Sports Insurance

- Sports Player and Teams Insurance

- Sports Team Coaching Insurance

Leisure Insurance

- Boat Insurance

- Music Insurance

- Photography Insurance

- Caravan Insurance

Personal Insurance

- Valuables Insurance

Business Insurance

- Drone Insurance

- Personal Trainer and Fitness Instructor Insurance

- Small Business Insurance

- DJ Insurance

- Our products

- Work for us

- How to Complain

- Terms of Business

- Terms of use

- Privacy Policy

© Copyright Ripe Thinking Limited 2024

Insure4Boats® is a registered trademark and a trading name of Ripe Insurance Services Limited which is Authorised and Regulated by the Financial Conduct Authority No.313411. Registered office: The Royals, Altrincham Road, Manchester M22 4BJ. Registered in England No. 04507332.

- Aerospace & Aviation Overview

- Aircraft Hull Deductible Insurance

- Airline Insurance & Risk Management

- Airshow Insurance

- Drone Insurance

- Glider Insurance

- Gyrocopter Insurance

- Helicopter Insurance

- One Up, One Down Aviation Insurance Policy

- Space & Satellite Insurance

- Vintage Aircraft Insurance

- Art, Jewellery & Specie Insurance Overview

- Art, Museums & Exhibitions Insurance

- Fine Art Insurance

- Jewellers Block & Specie Insurance

- Automotive Overview

- Classic Car Restoration Insurance

- Driving Instructor Insurance

- Limousine Insurance

- Self-Drive Car Hire Insurance

- Care Overview

- Care Home Insurance

- Care Insurance

- Children's Home Insurance

- Domiciliary Care Insurance

- Fostering & Adoption Agencies

- Supported Living Insurance

- Charities & Not For Profit Overview

- Buddhist Temple Insurance

- Charity Insurance

- Charity Shop Insurance

- Community Transport Insurance

- Minibus Insurance

- Social Housing Insurance

- Youth Club Insurance

- Construction Overview

- Construction Insurance

- Contractors Insurance

- CPA Members Insurance

- Roofing & Scaffolding Insurance

- Surety Bonds

- Tradesman Insurance

- Education Overview

- Education Insurance

- Schoolshare

- Energy Overview

- Renewable Energy Insurance

- Energy Insurance

- Farming Insurance

- Hospitality, Leisure & Tourism Overview

- Hospitality & Leisure Insurance

- Holiday & Home Parks Overview

- Holiday Home Owner Insurance

- Holiday Let Insurance

- Holiday & Home Parks Insurance

- Theme Park & Leisure Attractions

- Legal and Indemnity Overview

- Dispute Resolution

- Legal Indemnity

- Professional Indemnity

- Warranty & Indemnity

- Life Sciences Overview

- Clinical Trials Insurance

- Life Sciences Insurance

- Life Sciences Start-Up Insurance

- Manufacturing Overview

- Manufacturing & Heavy Engineering

- Food & Drink

- Marine Overview

- Commercial Craft Insurance

- Marine Trade Insurance

- Superyacht Insurance

- Yacht & Motorboat Insurance

- Media & Entertainment Overview

- Firework & Pyrotechnics Insurance

- Media, Entertainment & Events Insurance

- Motor Trades Overview

- Auto Electrician Insurance

- Body Shop Insurance

- Breakdown & Recovery Agents

- Car Dealership Insurance

- Car Valeting Insurance

- Combined Motor Trade Insurance

- Mobile Mechanic Insurance

- MOT & Service Stations Insurance

- Motor Trade Insurance

- Motorcycle Trader Insurance

- No-Claims Motor Trade Insurance

- Part-Time Motor Trade Insurance

- Road Risk Insurance for Motor Traders

- Service and Repair Garage Insurance

- Smart Repair Insurance

- Startup Motor Traders Insurance

- Tyre Fitter Insurance

- Vehicle Sales Insurance

- Young Motor Traders Insurance

- Public Sector

- Real Estate Overview

- Block of Flats Insurance

- Estates Insurance

- Freeholders Insurance

- Landlord Insurance

- Legal Indemnity Insurance

- Propertymark Members

- Real Estate Insurance

- Unoccupied Property Insurance

- Transportation Overview

- Courier Fleet Insurance

- Courier Van Insurance

- Goods in Transit Insurance

- Hanson Franchisee Insurance

- Haulage & Distribution Insurance

- Passenger Transport Insurance

- Railway Insurance

- Taxi Fleet Insurance

- Taxi Insurance

- Transportation Insurance

- Vehicle Transporters Insurance

- Technology & Telecommunications Overview

- Hardware & Electronics Insurance

- Media Insurance

- Software & IT Services Insurance

- Technology Insurance

- Telecommunications Insurance

- Travel Overview

- Airline Personnel Travel Insurance

- Group Business Travel Insurance

- Scheduled Airline Failure Insurance

- Travel Agents Insurance

- Travel Insurance

- Corporate Insurance Overview

- Casualty Insurance

- Claims Management

- Commercial Property Insurance

- Crisis Management Overview

- Crisis Resilience Insurance

- Kidnap & Ransom Insurance

- Terrorism Insurance

- Cyber Liability

- Delegated Authority

- Directors & Officers Liability

- Dispute Resolution Insurance

- Fleet & Commercial Vehicle Insurance

- General Liability Insurance

- Intellectual Property Insurance

- Latent Defects Insurance

- Mergers & Acquisitions

- Professional Indemnity Insurance

- Retail Insurance

- Structured Credit & Political Risk Overview

- Commodity Traders

- Credit & Political Risk Cover

- Non-Payment Insurance for Banks

- Private Equity

- Public Agency & Multilateral Organisations

- Trade Credit

- Warranty & Indemnity Insurance

- Personal & Household Overview

- Aviation Insurance Overview

- Landlord Overview

- HMO Landlord Insurance

- Multi-Property Landlord Insurance

- Student Landlord Insurance

- Golfers Insurance

- Home & Contents Overview

- Home Insurance

- High Net Worth Home Insurance

- Holiday Home Insurance

- Non-Standard Home Insurance

- Thatched Property Insurance

- Motor Overview

- Car Insurance

- Prestige & Classic Car Insurance

- Van Insurance

- Risk Management Overview

- Business Continuity Planning

- Cyber Risk Management

- Enterprise Risk Management

- Fleet Risk Management

- Health & Safety Risk Management

- Property Loss Control

- Small Business Insurance Overview

- Builders Insurance

- Professional Indemnity Overview

- Accountants Professional Indemnity Insurance

- Gardeners Insurance

- IT Consultant Insurance

- Public Liability Insurance

- Shop & General Retail Overview

- Restaurant Insurance

- Shop Insurance

- Specialist Solutions Overview

- Affinity Partnership Schemes

- Alternative Therapists Insurance

- Dance Teacher's Insurance

- Fitness Instructor Insurance

- Hairdresser & Barber Insurance

- Members and Visitors Insurance

- Office Insurance

- Personal Trainer Insurance

- Recruitment Agency Insurance

- Removals & Storage Insurance

- Rope Access Insurance

- Tanning Salon Insurance

- Travel Agents & Tour Operators

- Tradesman Overview

- Carpenter Insurance

- Electrician Insurance

- Handyman Insurance

- Plumber Insurance

- Self-employed Insurance

- Tree Surgeon Insurance

- Window Cleaner Insurance

- Culture Change Consulting

- Communication Consulting

- Financial Wellbeing Solutions

- Organisational Wellbeing Overview

- Organisational Wellbeing Consulting

- Diversity, Equity and Inclusion Consulting

- Employee Benefits Consulting Overview

- Asset Management

- Benefits Strategy

- Flexible Benefits & Technology

- Healthcare & Protection

- Multinational Benefits

- Workplace Pensions

- Reward Consulting Overview

- Bonus Plan Design

- Executive Remuneration

- Gender Pay Reporting

- HR and Reward Training

- International Reward Management

- Job Evaluation

- Long Term Incentive Plans

- Pay Benchmarking

- Reward & Recognition

- Salary Surveys

- Share Schemes & Sales Incentive Plans

- News & Insights

- Gallagher Better Works

- Media Centre

- The Gallagher Way

- UK Executive Team